End of Tax Year Conversations

For many of us as the clock strikes midnight on the 31st December it is a time for reflection on what has happened in the previous twelve months as well as a new start with many hopes and aspirations for the year to come.

However, how many business owners, employees or entrepreneurs would think to do the same thing at the end of the tax year on the 5th April? Each year, on the 6th April, a new tax year begins bringing with it many changes in legislation such as amendments to the rates to income tax, corporation tax, inheritance and capital gains tax.

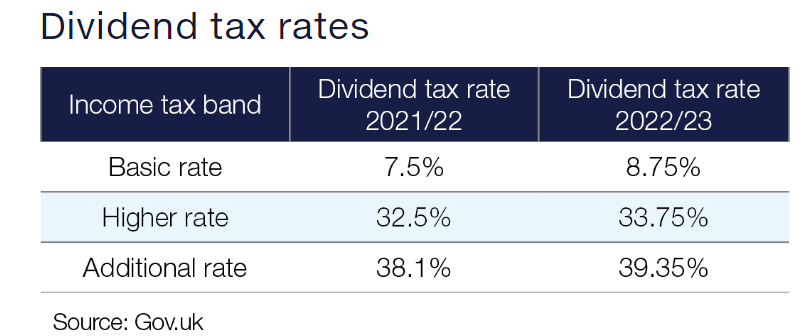

Being fully aware of all the changes will help you to make the most informed and tax efficient decisions. As a simple example, a business owner who is a basic rate tax payer voting a £20,000 dividend in April to themselves would pay tax of £1,500 on this income if the dividend was voted on the 5th April 2022. However, if the same dividend was voted on 6th April 2022 instead this would attract income tax of £1,750 due to a change in the dividend tax rate from 7.5% to 8.75% for a basic rate tax payer.

There are also a number of other changes, for example:

A number of relaxed tax rules to accommodate working from home are due to end

Annual increase in taxes charged on company cars and fuel paid for by the company

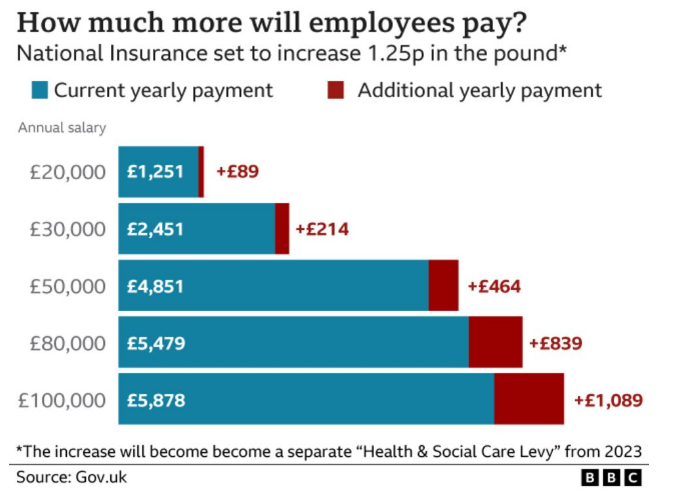

A new Health & Social Care levy initially being raised through a 1.25 increase in percentage points on the national insurance rate

Changes in legislation can often seem difficult to understand, but we at BSN are here to take the stress out this for you. As we approach the 5th April, now is the ideal time for you to come and speak us about any plans, concerns or decisions you might like to make in the future. Our friendly team will look at your unique circumstances providing you with advice on how you can make the most tax efficient decisions possible.

At BSN we are not just accountants, we are with you every step of the way.